Contents:

For example, imagine if governments doubled individual tax rates. This change would likely have major repercussions on business, individuals, and other sectors within the circular flow model. The circular flow model demonstrates how money moves from producers to households and back again in an endless loop. As such, for an independent economy isolated from the outer world, it becomes imperative for the households to spend and consume.

circular flow of economic activity Sector includes the import and export of goods and services. This leads to the receipt of foreign factor income and payment. Modern states, like the private sector, export and import commodities / services, as well as loan to and borrow from other nations. The government collects payments through globally for all products exported. When families need a good or service, their money goes to the product market in the process of consumer spending.

Resources

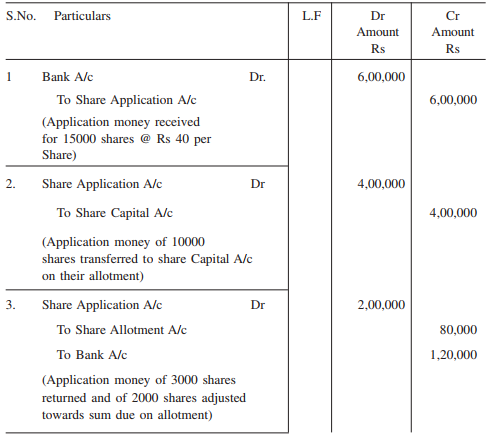

The government injects money into the circle through government spending on programs such as Social Security and the National Park Service. It also extracts money from households and businesses by way of taxes. In a two-sector model, circular flow models also include the business sector that produces the goods. Businesses absorb a variety of production costs including labor, materials, and overhead. As a result, many companies are able to manufacture products that benefit other parties. That is the basic form of the model, but actual money flows are more complicated.

The First Laws says matter and energy cannot be created or destroyed, and the Second Laws says that matter and energy move from a low entropy, useful, state towards a less useful higher entropy state. Thus, no system can continue without inputs of new energy that exit as high entropy waste. Just as no animal can live on its own waste, no economy can recycle the waste it produces without the input of new energy to reproduce itself.

Circular Flow Of Economic Activity – The Fundamentals Of Managerial Economics

Likewise, many https://1investing.in/es provide facilities to overseas nations, such as transportation, banking, insurance, and so on, for which they are paid from overseas. This is how financial and real resources flow in an economy and hence constitute circular flow of economic activity. Both micro and macroeconomics are explained with theories and models.

Insurance companies, both life and general, form part of the financial institutions sector. They play a vital role in channelizing surplus funds of households to various productive enterprises. It receives its revenues in the form of direct and indirect taxes, from firms and households. In turn it makes various kinds of factor and transfer payments to households and also provides funds to firms in the form of subsidies and purchases. With respect to foreign countries, we have export of manpower to foreign countries. These non residents in turn make remittances to the home country, resulting in precious foreign exchange coming in.

- He has a BA in Communication studies from the North-West University and has completed his TEFL qualification.

- Representation of reciprocal financial and real flows between economic factors.

- So far the circular flow has been shown in the case of a closed economy.

- Therefore the money that individuals receive from working in the factor market is then spent in the product markets acquiring goods and services.

- This model includes the household sector, producing sector and government sector.

Money can move into this system by way of injections or flow out in the form of leakages. The two-sector circular flow model depicts the movement of money between companiesand households. Households offer their production factors to companies in exchange for money that they can then use to buy goods and services from companies. Beyond the two-sector model, the three-sector flow model illustrates a slightly more complex flow of money and capital as it includes the government in the center. Households and companies pay taxes to the government in order to receive public services.

Circular Flow of Income in a Three-Sector Economy

Once we understand this, we understand the circular flow of economic activity. Keynesian approach of income also tells us the most important condition which must be fulfilled before the economy is said to be in equilibrium, i.e., the important condition of saving being equal to investment. What are ‘costs’ to business are ‘incomes’ to the factors such as the workers and the resource-owners. It is expenditure by the consumers that determines the income of the producers. It will increase the earnings of the (actors and their spending’s and so on.

By extension, this indicates that the two-sector or three-sector models are domestic activity only. The foreign sector is different from the domestic sector as there may be administrative inefficiencies that result in lost cash flow due to import taxes, duties, or fees. This act on the part of the government to levy taxes and to spend more is called fiscal action.

The Circular-Flow Model of the Economy

This will reduce the household consumption as well as saving, which in turn, will reduce business sales. But if there is a new source of injection in the form of government purchase and expenditure on goods and services, it will offset the affects of the tax leakage. We know that the economic activities and money have a circular flow. Circular flow of money means that the money spent must not be hoarded and should continue to flow to maintain a certain Level of economic activity and income. Businesses also provide banking, overseas shipping and insurance services. Also, interest, dividends and profits to investments made with foreign countries.

Households provide labor, capital, and other factors of production to firms, and this is represented by the direction of the arrows on the “Labor, capital, land, etc.” lines on the diagram above. The circular flow model of economic activity is used to explain the relationship between businesses, households, and the government. Learn about the flow of goods and services in a market economy, the factors of production, and how the circular flow model of economic activity applies to real-world situations. The three sector model of a simple economy shows the circular flow of economic activity involving government transactions. Government incurs expenditure on goods and services and gets receipts in the form of taxes.

- The household sector buys the goods & services produced by the business sector.

- It is a flow since income that is saved, increases the stock of wealth.

- In a mixed economy, the government strengthens the market system.

- They’ll even set aside some of the taxes to help Margie and Dave later on in life when they’re retired.

The main injection provided by this sector is the exports of goods and services which generate income for the exporters from overseas residents. An example of the use of the overseas sector is Australia exporting wool to China, China pays the exporter of the wool therefore more money enters the economy thus making it an injection. Another example is China processing the wool into items such as coats and Australia importing the product by paying the Chinese exporter; since the money paying for the coat leaves the economy it is a leakage. The money flows back to households when foreign countries give them employment. For firms, money flows back when foreign countries purchase goods and services, also called exports. With the introduction of the foreign sector, the scope widens further.

Households purchase goods and services that businesses provide through the product market. Trade, meanwhile, requires resources to produce goods and services. Members of families provide labor to businesses through the resource market.

Labor markets are the most commonly discussed form of a factor market, but it’s important to remember that factors of production can take many forms. The fundamental decision making units in a market economy are firms and households. Firms take resources and transform them into products that people or other firms wish to purchase. Individuals purchase goods and services from businesses, and their expenditures go to businesses. Firms purchases resources, such as labor from households, and the money they pay for these resources go to households.

For example, wages for labourers, interest & profit for capital and rent for the land. This is the revenue approach in relation to national accounting. Economic growth will occur if the country’s output of goods and services increases over time. The circular flow diagram will continue to expand, and more and more items will be for sale as long as people have jobs and continue to spend their money on those products. If people lose their jobs or are fearful about the future, they will not spend money, which would hurt the circular flow of economic activity, and the overall economy will contract. The fifth sector – the financial sector – is added to complete the circular flow model.

CIBC’s 2023 Annual Meeting of Shareholders – Meeting Materials Now Available – Canadian Imperial Bank (NY – Benzinga

CIBC’s 2023 Annual Meeting of Shareholders – Meeting Materials Now Available – Canadian Imperial Bank (NY.

Posted: Thu, 02 Mar 2023 01:34:33 GMT [source]

In the above model, we can see that the firms and the households interact with each other in both product market as well as factor of production market. The product market is the market where all the products by the firms are exchanged and factors of production market is where inputs such as land, labor, capital and resources are exchanged. Households sell their resources to the businesses in the factor market to earn money.